INTRODUCTION

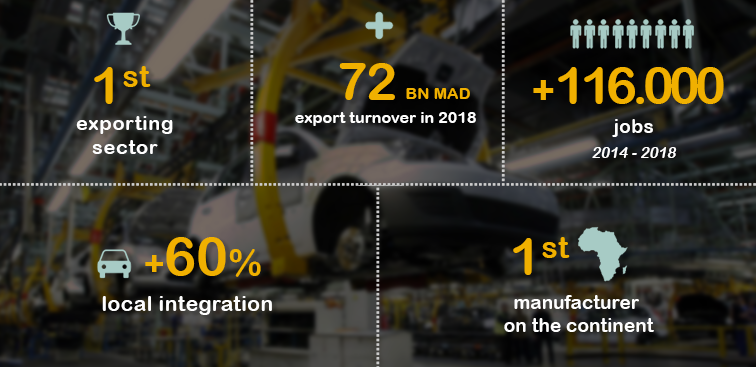

The Moroccan automotive industry has risen to sustained levels of growth over the last decade. Its performance is particularly remarkable for export and in terms of job creation, indicators for which the segment generated an annual double-digit growth.

The positioning of Morocco as aplatform of production and export of equipments and motor vehicles is consolidated by the setting-upof renowned foreign groups such as RENAULT, SNOP, GMD, BAMESA, DELPHI, YAZAKI, SEWS, SAINT-GOBAIN and more recently Peugeot Citroën

Strategic sector in the national industrial policy, since the 2000s, the automobile industry release a two-digit annual growth towards the creation of employment and export.

Ecosystems

To provide the best support to the automotive industry, the 2014-2020 Acceleration Plan and the new ecosystem approach which it introduces bases to a steady and long-lasting development of the companies of the sector.

The new strategy reinforces the expanded value offer and further anchors the Morocco destination in the global automotive industry. The new ecosystem approach promote greater integration of the sector, as well as a better organization of his actors who win in competitiveness, in quality and in reactivity.

To boost the productivity of business operators, an appropriate support and targeted assistance are made to business ecosystems regarding financing, industrial land and training.

Eight ecosystems were set up, to date, in the automotive industry. They concern the sectors of "automotive wiring", "Vehicle interior and seats", "Metal pressing"," automotive batteries", "heavy goods vehicles and industrial bodywork" , "Motors and transmission" and two car manufacturers ecosystems, "Renault" and "PSA" .

The ecosystem Motors and Transmission illustrates the point of inflection which knows our industry; the Kingdom joined, in record time, the closed circle of motors exporters , proof again, of the technological step which we crossed. Morocco will have browsed in only 14 years, a path which will have required on average 17 years to Emerging countries.

ASSISTANCE AND SUPPORT

Integrated and innovative support measures have been implemented to benefit the automotive ecosystems:

Tailored financial support:

Training opportunities:

Skills training for 90,000 profiles fitting the specific needs of the sector.

Attractively priced rental property:

275 hectares of rental property reserved for the automotive industry of which 95 hectares are already committed.

The establishment of a Centre of Studies, Testing and Development.

Specific help for companies of the “heavy goods and industrial bodywork” ecosystem

This assistance is intended to:

To guide the development of the “Powertrain” sector, companies will receive appropriate support:

Under the Investment Charter, the FPI offers partial coverage by the Government of certain expenses related to the acquisition of property (up to 20% of the cost of land), external infrastructure (up to 5% of the total amount of the investment programme, or 10% in the case of an investment in the sector of spinning, weaving or finishing) and vocational training (up to 20% of the cost of the training).

These contributions may be combined as long as the total contribution of the state does not exceed 5% of the total investment programme; or 10% in the case of investment in the sector of spinning, weaving or finishing; or when the investment project is located in a suburban or rural area.

Eligibility criteria:

The investment project must meet at least one of the following five criteria:

The Hassan II Fund offers grants of up to 15% of the total investment amount, capped at 30 million dirhams, with the following conditions:

With regard to the automotive industry only: 15% of the purchase of used equipment imported and intended for stamping, plastic injection or in the manufacture of tools and moulds (excluding any other state contribution paid for the acquisition of capital goods).

The total amount of the investment (excluding import duty and tax) must be 10 million dirhams or more and the investment in goods and equipment (excluding import duty and tax) must be 5 million dirhams or more.

The investment file must include the following documents:

Tax incentives are provided for by article 123-22°-a) of the General Tax Code and Article 7.1 of finance law No. 12-98 for the 1998/9 budget year as amended and supplemented by the following:

SMEs in the sector may benefit from special support within the programmes developed by MAROC PME:

A free trade zone (ZFE) is a specified area of land devoted to export activities for industrial purposes and related service activities. Each free zone is created and delimited by a decree that determines the nature and business activities that can be established there.

The operational free trade zones are located at Tangier (Tanger Free Zone – TFZ and Tanger Automotive City – TAC), at Kenitra (Atlantic Free Zone – AFZ), at Casablanca (Midparc), at Rabat (Technopolis) and at Oujda (Technopole d’Oujda).

To obtain free zone status under law No. 19-94, companies must have obtained authorization from the local commission of the free export zone, which is presided over by the wali or governor of the region, and must make at least 70% of their turnover from exports.

Free zone status allows for the exemption of foreign trade and exchange controls, as well as access to the following state aid:

Tax incentives resulting in:

Customs benefits:

Administrative facilitations:

-

- Investment incentives.

- Incentives for local integration.

- Support for leading trades reaching up to 30% of total Investment.

- Promote investment (offers for installation and extension of production capacity);

- Support companies driving the ecosystem (granting bonuses);

- Gradual reduction in the age of vehicles on the road (not to exceed 20 years by 2020);

- Optimization of loads in circulation (increase of gross weight and setting up standardized dimensions);

- Increase of procurement orders offered to the sector;

- Relaxation of eligibility conditions for obtaining a grant for renewing fleets, and extending it to include any haulage contractor with heavy goods vehicles over 15 years old;

- The establishment of a semi-trailer funding scheme in partnership with banking institutions (extended financial leasing);

- Access to property (provision of 200 hectares at an attractive price);

- Support for training.

- Investment support from the Industrial Development and Investment Fund (FDII), financing up to 30% of the overall investment.

- Providing easier access to real estate (15 ha of rental land is dedicated to the sector).

- Supporting competitiveness of Very Small, Small and Medium-sized Enterprises and self-entrepreneurs

- An integrated training plan, adapted to the needs of the sector

- Financial support for engine laboratories

- Supporting the extension of self-entrepreneur status for scrap metal collection activities.

- Represent an amount of 200 million dirhams or more over a 3-year period;

- To be located in one of the provinces or prefectures mentioned in Decree No. 2-98-520 dated 5 Rabii I 1419 (30 June 1998);

- Create a minimum of 250 stable jobs over 3 years;

- Provide technology transfer;

- Contribute to the protection of the environment.

- 30% of the cost of professional buildings on the basis of a maximum unit cost of 2,000 dirhams per square meter before tax (excluding any contributions by the state for the acquisition of property and/or the construction of professional buildings);

- 15% of the cost of acquisition of new capital goods (excluding import duty and tax) (excluding any contributions by the state for the acquisition of capital goods).

- The statutes of the company;

- A detailed description of the investment project;

- The references of the investor;

- The cost of the project and the number of jobs created;

- The method of financing the project;

- The architectural plans of the buildings;

- Surveying certificate;

- A list of new equipment to purchase, with quotes;

- Installation plans with all equipment shown to scale, with the designation of all equipment (in line with the aforementioned list of equipment);

- The project schedule;

- A completed application form requesting assistance from the Hassan II Fund.

- The exemption from import duty on capital equipment, materials and tools necessary for the implementation of an investment project with a total cost greater than 200 million dirhams during 36 months after the signing of the investment agreement; this exemption is extended to parts, replacement parts and accessories imported at the same time as the aforementioned equipment;

- The exemption from VAT on imports of capital equipment, materials and tools necessary for the implementation of an investment project with a total cost greater than 200 million dirhams until 36 months after the start of activity by the company or from the date of issuance of the building permit, and which may be extended by six months in the event of force majeure (renewable once); this exemption is extended to parts, replacement parts and accessories imported at the same time as the aforementioned equipment.

- Exemption from income tax (IR) during the first 5 years, and then a reduction of 80% of tax on gross earned income during the following 20 years;

- Exemption from corporation tax (IS) for the first 5 years, and then a rate of 8.75% for the following 20 years;

- Exemption from professional tax for the first 15 years;

- Exemption from urban tax for the first 15 years;

- Exemption from participation in national solidarity;

- Exemption from tax on income from corporate rights, dividends and similar income for non-residents and a reduction in tax to 7.5% for residents;

- Exemption from import duties, and simplified customs procedures;

- Unlimited exemption from value added tax in respect of products delivered and services supplied to the free export zones and from the subjected territory;

- Exemption from registration fees and stamp duty on instruments of incorporation or increases in the capital of the company, as well as on land acquisitions;

- The establishment of a one-stop service to the investor.

TRAINING

Features of IFMIA

| Training method | Maximum intake | Start date | |

| Casablanca (quartier Sidi Moumen) |

Training upon hiring, initial and continuous | 800 places | April 2013 |

| Kenitra (Atlantique Free Zone) | Training upon hiring and continuous | 500 places | February 2014 |

| Renault Tanger Méditerranée (RTM) (zone franche de Mallousa) |

Training upon hiring and continuous | 700 places | April 2011 |

| Tanger Free Zone | In initial phase of construction | ||

The training of human resources is a strategic activity of the Industrial Acceleration Plan 2014-2020. The availability and quality of human resources determine the attractiveness of Morocco as a destination, and increase the productivity and competitiveness of the companies. Amongst other things the strategy aims at providing the ecosystems in place with skilled profiles.

The detailed mapping of training needs - with a quantification of the human resource requirements by sector, profile, region and year - and the identification of training opportunities available in Morocco are ongoing, which will enable the development of a national training plan.

In the automotive sector the objective is to create a pool of skilled workers by introducing 4 Vocational Training Institutes for the Automotive Industry (IFMIA) – in Casablanca, Kenitra and Tangier – with direct aid for training of up to 65,000 dirhams per person. The method of governance of these institutes is a public-private partnership (delegated management).

Consult the list of training needs for performance contracts signed by end - May 2017

Reception Infrastructure

في إطار مخطط تسريع التنمية الصناعية، تنوي الوزارة تخصيص 1000 هكتار لإنشاء مناطق صناعية للكراء مع منشآت جاهزة : سيتوفر كل مجمع على شباك إداري وحيد، وسوق محلّية لليد العاملة، وخدمات خاصة وآلية لتكوين الموارد.

وبالموازاة مع ذلك، تضمن محطات صناعية مندمجة عامة وقطاعية - قد تستفيد من وضع منطقة التصدير الحرة لاحقا- وتوفر وعاء عقاريا تنافسيا، وخدمات عقارية ولوجستية متكاملة ومتنوعة حسب أعلى المعايير الدولية، إضافة إلى خدمات في عين المكان وشباك إداري وحيد.